LOCKHEED MARTIN

TEAM MEMBERS

Tim Estes, Brie Reyes, and Top Gun Advisors are uniquely qualified to help Lockheed Martin Team Members with the management of their Fidelity 401K plan. Using Brie’s extensive financial background, and her personal knowledge of Lockheed Martin’s retirement plan she is able to help Lockheed Martin employees “Add Some Jet Fuel to Their 401K.”

Through innovative propriety algorithms, we can help you fortify your investment strategies against volatility to ensure your retirement plan is working as hard as you are and can focus on what really matters.

DEFENDING OUR NATION.

Your retirement account is likely one of your largest assets.

Are you allowing it to adapt for optimum results?

For most in the Defense Sector, the answer is absolutely not. Smart investment decisions within your retirement account are mission critical since the funds you accumulate over the coming years may need to support you through many years of retirement.

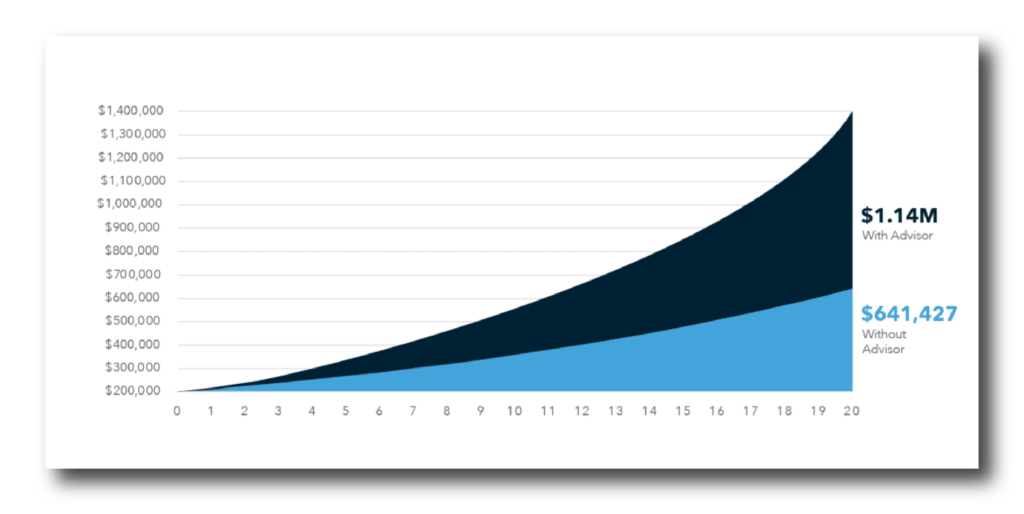

According to a recent study, investors who used some form of investment “help” achieved returns nearly 3% higher than those who did not receive help.

For a 45-year-old participant that seeks the help of a financial professional it could translate to 79% more wealth at age 65.3.

– FINANCIAL ENGINES & AON HEWITT

We Can Help You Complete Your Retirement Mission

LOCKHEED MARTIN HAS ENHANCED YOUR EMPLOYER-SPONSORED QUALIFIED RETIREMENT PLAN TO INCLUDE ACCESS TO PROFESSIONAL MONEY MANAGEMENT THROUGH A SELF-DIRECTED BROKERAGE-LINK RETIREMENT ACCOUNT OPTION. THIS ALSO DELIVERS THOUSANDS OF OTHER INVESTMENT MODEL OPTIONS FOR YOUR RETIREMENT ACCOUNTS.

Lastly, according to a Vanguard study of 40,000 participants, managed accounts have a notable effect on returns due to increased equity exposure and savings rates, as well as a reduction in portfolio risk levels and costs. Of the participants surveyed, it was reported that:

- 60% increased their projected 10-year retirement wealth by an average of 30%.

- 30% earned value through a reduction in portfolio risk.

- 1/3 chose to increase their savings rate by an average of 3%.

- 60% saw a reduction in average fund fees.

- Expense ratios were reduced by an average of 0.06%.